Shelf Positioning: Strategy, Types, Examples and Retail Execution Guide

Learn what shelf positioning is, why it matters, types, strategies, and examples. Improve retail visibility and sales with smart shelf execution techniques.

Learn what shelf positioning is, why it matters, types, strategies, and examples. Improve retail visibility and sales with smart shelf execution techniques.

Walk into any modern retail store and you'll see hundreds of brands competing silently for a shopper’s attention. Most of those purchasing decisions don’t happen in boardrooms, during product strategy meetings, or even through advertising—they happen right in front of the shelf. Research shows that over 70% of buying decisions are made in-store, and what influences them most is not just price or brand recall—but shelf positioning.

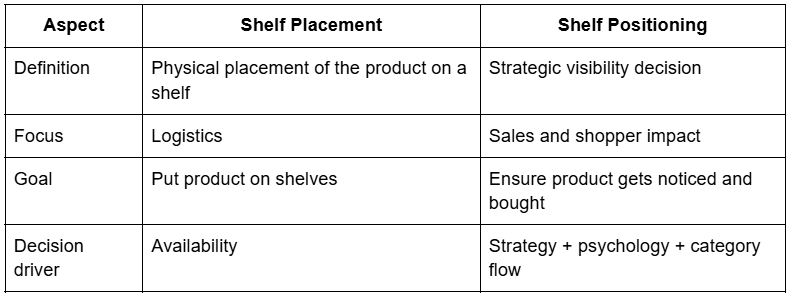

Shelf positioning is far more than “putting products on a shelf.” It’s a deliberate visibility strategy engineered to influence how customers see, evaluate, and choose products. It determines whether your brand gets prime attention—or gets lost in clutter.

Here’s the uncomfortable truth:

Even strong brands lose sales every day not because of low demand—but because of poor shelf visibility. If your product is placed on the bottom shelf, buried behind competitor SKUs, or misplaced far from its logical category zone, it becomes invisible to the shopper’s eye—and invisible products simply don’t sell.

Physical shelf space is one of the most valuable and expensive assets in retail. The brands that win retail growth aren’t always the ones with the biggest marketing budgets—it’s the ones who win on the shelf. Strategic shelf positioning increases:

Leading retail brands treat shelf positioning as a performance discipline, supported by data, optimized through field execution, and monitored continuously for compliance. This article breaks down:

Shelf positioning refers to the strategic placement of products on retail shelves to maximize visibility, influence buying decisions, and increase sales. It is a science-backed approach that combines consumer psychology, merchandising strategy, and shelf analytics to determine where a product should be placed and why.

In simple terms:

Shelf positioning = Shelf location + Product visibility + Shopper intent

It’s not just about getting products into stores—it’s about putting them in the right position to sell.

People don’t walk into stores looking for every product—they find what grabs their attention. Shelf positioning helps:

A well-positioned SKU can outperform a better product that’s hidden or poorly placed. That’s the real power of shelf positioning.

A typical shopper spends less than 7 seconds looking at a category before making a choice. They scan shelves in natural visual patterns—top to bottom, left to right, front to back—which means brands must position strategically to align with how people shop.

Smart shelf positioning helps answer:

In retail, shelf positioning is one of the biggest revenue drivers, yet it’s one of the most undervalued. It’s not just about where products sit—it’s about how effectively a brand competes inside the store. Retail shelves are the final battleground where brands win or lose against competition, and shelf positioning decides who gets noticed—and who gets ignored.

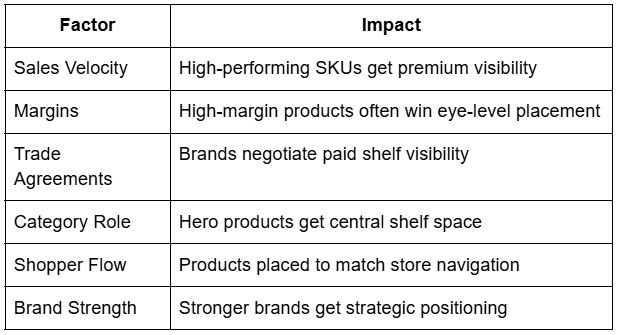

Retail shelves may look simple, but the placement strategy behind them is highly deliberate. Retailers use a combination of commercial agreements, performance history, and merchandising logic to assign shelf space. Key shelf positioning decisions are based on:

Shelf space is like real estate in retail. Just like prime property has higher value, premium shelf positions deliver higher conversions. That’s why major FMCG and retail brands invest heavily in achieving strong shelf visibility.

Winning shelf positioning means:

In short, better shelf positioning equals better sales.

Retail shelf positions are not random; they are often influenced by financial negotiations between brands and retailers. This is especially true in modern trade and large format retail where brands pay for:

Brands don’t just fight for market share—they fight for shelf share.

Retail teams today no longer rely on guesswork or visual assumptions. Brands use field data, shelf analytics, and planogram insights to measure and optimize their shelf strategies.

Questions retail teams now ask:

This is why shelf positioning has become a strategic KPI in retail execution—one measured and optimized at scale across markets.

Shelf positioning is not just a merchandising decision—it’s a revenue strategy. The way a product is positioned on the shelf has a direct influence on shopper attention, brand perception, and purchase conversion. Here’s why it matters so much in retail:

Shoppers can’t buy what they can’t see. Most customers don’t go searching through every shelf; they make impulse choices based on what is most visible and easy to spot. Products positioned at eye level or in high-traffic sections consistently outperform those hidden at the bottom or corner shelves.

Customers scan shelves in predictable visual zones. Eye-level shelves get the most attention, followed by hand-level and waist-level. Bottom shelves receive the least engagement. Poor positioning reduces the chance of a product even being seen—let alone being purchased.

Shelf position also communicates value. Products placed at premium eye-level positions are subconsciously perceived as better in quality. On the other hand, products thrown on the bottom shelf are often assumed to be cheap, ignored, or low in demand—even if that’s not true.

When a brand improves its shelf positioning—more facings, better location, better blocking—it begins to occupy more mental space for the shopper. This increases its category share without even changing price, packaging, or promotions.

Even if brands invest in advertising, social media, and promotions, a bad shelf position can kill conversions. The final moment of decision happens in front of the shelf. That’s why shelf positioning is the last mile of marketing.

When a product is placed next to higher-priced items at eye level, it appears more premium. When placed next to cheaper alternatives, it feels overpriced. Shelf position impacts how value is perceived and whether a product feels worth it.

Strategic shelf placement—like near checkout counters or in power aisles—captures last-minute impulse buys. These placements are critical for high-velocity categories like beverages, chocolates, snacks, and beauty products.

Shelf positioning isn’t random—it follows strategy. Different products are placed in different shelf locations based on how shoppers search, compare, and decide. Understanding the types of shelf positioning helps brands plan smarter merchandising and negotiate better visibility.

Below are the most common and effective types of shelf positioning used in retail.

This is the most widely used retail shelf strategy, based on how the shopper’s eye naturally moves.

Strategic shelf areas can influence shopper traffic and conversion dramatically.

Products are positioned to match how shoppers think and shop.

Retailers also use shelf positioning to drive commercial outcomes.

Shelf positioning becomes much easier to understand when we see it in action. Here are some practical, real-world examples that show how strategic placement influences shopper behavior and sales.

When you walk into a supermarket, Coca-Cola is almost always placed at eye level or on end-cap displays. Why? Because Coca-Cola negotiates premium shelf space to dominate visibility. Local cola brands are usually pushed downward to bottom shelves, where they get less visibility and lower sales.

Shelf positioning lesson: Premium shelf space protects market share.

Cadbury Dairy Milk and other chocolate brands are frequently displayed near billing counters. These are known as impulse zones, where shoppers grab items while waiting. This boosts last-minute purchases—especially among kids.

Shelf positioning lesson: Position products where buying decisions are spontaneous.

Visit the hair care aisle, and you’ll often see brand blocking—entire sections dedicated to one brand like Dove, Sunsilk, or L'Oréal. Grouping products vertically or horizontally increases visual dominance and improves recognition.

Shelf positioning lesson: Occupy visual space to strengthen brand recall.

Shelf positioning may look simple on the surface, but behind it lies a structured decision-making process involving data, negotiation, store layout science, and shopper psychology. Retailers don’t assign shelf locations randomly—they allocate them based on commercial value, category strategy, and performance metrics.

Here’s how shelf positioning is typically decided in retail:

High-performing SKUs get better visibility. Products with strong sales velocity are rewarded with eye-level shelves or priority placement because they drive category growth and revenue for the retailer. If a product sells well, it earns better shelf positioning over time.

In modern retail, shelf positioning is often influenced by commercial agreements between brands and retailers. Brands negotiate for:

Retailers assign shelf space based on category flow and customer buying patterns. For example:

Retailers analyze how shoppers move, scan, and pick products on the shelf. Shelf placement decisions are often based on:

Products with higher margins or premium positioning potential are placed in more influential zones. For example, retailers often place private label products next to bestsellers to encourage profitable trade-ups.

Shelf positions are also chosen based on how fast products move. High-velocity products are placed in easy-reach zones to refill quickly, reducing stockout risk and labor effort.

Established brands that drive customer traffic are given front-facing positions because retailers know those brands attract buyers into the aisle. These brands often act as anchors to guide category layout.

Winning shelf space isn’t luck—it’s a strategy. Strong brands don’t wait for retailers to decide their fate on the shelf. They earn, negotiate, and justify better shelf positioning through smart execution and data-backed persuasion. If you want your products to get noticed and move faster, here’s how to build a winning shelf positioning strategy.

Retailers care about one thing: sales per square foot. If you want better shelf space, prove your product drives revenue and velocity.

Data-backed negotiations lead to better shelf positioning.

Identify your top 20% SKUs that drive 80% of revenue. These must be prioritized for eye-level or hand-level placements, not buried in lower shelves. Hero SKUs win shopper attention and pull the rest of the portfolio.

More facings equal more visibility. If your brand only has one or two facings, shoppers can easily miss it.

Visibility creates authority on the shelf.

Instead of scattering SKUs, group them together. Brand blocking makes your products easier to find and visually stronger than fragmented placement.

Prioritize placement in high-traffic zones:

Strong brands treat these locations as mini billboards inside stores.

Smart placement boosts basket value. Place your products next to complementary items.

Cross-merchandising drives incremental sales without promotions.

Your packaging is your silent salesman. On a busy shelf, packaging must win the eye in seconds.

Better shelf packaging = better pickup rate.

Promotions are not just about discounts—they’re negotiation tools. Brands use promotional campaigns to earn premium, temporary shelf space.

Winning space is one thing—keeping it is another. Without strong retail execution, your shelf position can quickly deteriorate. Frequent store audits are essential to:

This is where modern retail teams use tools like Pazo to monitor shelf positioning in real time.

Shelf positioning and planograms are closely related concepts, but they are not the same. Many retail teams misunderstand the difference and end up focusing only on planogram layouts, forgetting the strategic importance of shelf positioning.

Shelf positioning is about deciding where a product should be placed to maximize visibility and sales impact. It answers questions like:

Planograms, on the other hand, are detailed visual layouts that guide the exact arrangement of products on the shelves. They show:

Shelf positioning sets the strategy. Planograms execute that strategy in the store.

You can have a great planogram, but if your product is assigned to a poor shelf position in the first place, it will not perform. That is why shelf positioning must be planned before designing planograms. In simple terms:

Shelf positioning decides where you fight.

Planograms decide how you fight.

Shelf positioning cannot be improved unless it is measured consistently. Strong retail teams track specific metrics to understand how well their products are positioned in stores and how shelf visibility is impacting sales performance. The following metrics help evaluate and optimize shelf positioning:

Measures the percentage of visible shelf space your brand occupies within a category. A higher share of shelf increases dominance and improves brand recall.

Tracks how many product facings are visible to shoppers. More facings increase visual impact, reduce the chance of being overlooked, and improve sales velocity.

Measures how many of your key SKUs are placed at eye level. Products placed at eye level are seen first and purchased more frequently.

Tracks whether store teams are following the agreed shelf layout. Low compliance means even a strong shelf strategy will fail in execution.

A combined score based on shelf level, number of facings, placement location, and adherence to category flow. It helps quantify shelf quality.

Monitors competitor presence in relation to your brand. If competitors gain more shelf space or better positions, it affects category share.

Tracks out-of-stock issues at the shelf even when inventory is available in the backroom. Poor shelf replenishment weakens your shelf presence.

Measures how many additional visibility points your brand has secured such as end caps, impulse zones, and promotional displays.

Evaluates how improved shelf positioning impacts sales. This connects execution efforts with business growth.

Tracks whether your products are positioned near relevant categories to drive cross-selling opportunities.

Measuring these metrics helps retail and merchandising teams know whether they are winning or losing the visibility battle inside stores. Without these measurements, shelf positioning becomes a guessing game instead of a performance strategy.

Even well-established brands lose sales inside stores because of poor shelf execution. Shelf positioning may seem straightforward, but there are common mistakes that weaken visibility and limit product performance. Avoiding these mistakes is essential for winning attention in competitive categories.

Placing key products below waist level or on bottom shelves reduces visibility and drastically lowers sales potential. Important SKUs must be prioritized at eye level or hand level.

One or two facings per SKU can make products easy to miss, especially in crowded categories. Low facings also increase the risk of gaps appearing on shelves.

Scattered products break brand recognition. When SKUs are not grouped together, shoppers struggle to identify the brand. Proper brand blocking increases shelf impact and improves brand recall.

Shelf positioning is always relative. If a competitor gains better shelf space or more facings, your products lose visibility. Not tracking competitor moves results in losing shelf dominance.

Products placed in the wrong section confuse shoppers and hurt sales. For example, placing olive oil far from cooking oils or keeping herbal teas away from health products breaks the shopper flow.

Relying only on primary shelves is a missed opportunity. Brands that do not secure additional placements like end caps, dump bins, and promo displays lose impulse sales.

Old, dusty, or empty-looking displays signal neglect and reduce customer trust. Lack of display maintenance weakens brand perception and reduces pick-up rate.

If one store follows the positioning strategy while others don’t, brand visibility becomes unpredictable. Inconsistent shelf execution limits impact and hurts campaign performance.

Even if a shelf strategy is designed well, it often fails because placement is not audited regularly. Lost facings, out-of-stock shelves, and misplaced SKUs are common in stores without monitoring.

Shelf design without considering customer decision patterns leads to missed opportunities. Positioning must align with how people scan shelves and compare products.

Shelf positioning mistakes are costly, but they are avoidable with the right retail discipline and execution tracking.

Consistent shelf visibility does not happen by accident. It requires disciplined execution and regular evaluation. The following checklist helps retail and merchandising teams optimize shelf positioning across every store.

This checklist ensures that shelf positioning is maintained consistently and improved continuously across stores. When executed regularly, it strengthens retail presence and protects market share inside stores.

Shelf positioning used to rely on manual checks, store visits, and guesswork. Today, leading retail brands and modern trade teams use technology to track, measure, and improve shelf visibility at scale. Technology turns shelf positioning from a visual assumption into a performance metric.

Here’s how technology enhances shelf execution:

Mobile audit apps and retail execution tools allow field teams to capture shelf data instantly. Instead of waiting days for manual reports, brands get a clear view of their shelf presence in real time.

Images taken during store visits help validate whether SKUs are positioned correctly, placed at eye level, or missing from shelves. Photo evidence creates accountability and reduces fake reporting.

Digital tools analyze shelf photos and audit data to highlight visibility gaps, lost facings, and share of shelf issues. Brands gain actionable insights into how shelf position affects sales performance.

Technology makes it easier to track competitor shelf presence. Teams can monitor which brands are gaining visibility space, running promotions, or expanding facings inside stores.

Instead of building manual reports, digital systems automatically generate compliance performance dashboards at store, region, and SKU levels. This enables faster and smarter decision-making.

Technology helps identify empty shelf spaces or out-of-stock issues before they affect sales. Instant alerts ensure quick replenishment and protect shelf performance.

Whether a brand is managing 100 stores or 10,000, technology makes it easier to enforce consistent shelf positioning across all locations. Central teams gain complete execution control.

Retail execution platforms can integrate planogram templates so auditors and store teams can compare actual execution against expected layouts. This improves accuracy and reduces execution gaps.

Technology does not replace retail execution teams. It empowers them with better visibility, faster control, and higher precision in shelf positioning. Brands that use technology are able to respond quickly, win visibility battles, and outperform competitors on the shelf consistently.

Shelf positioning only works when it is executed consistently across every store. The challenge for most brands is not strategy—it is visibility and control at the store level. That is where Pazo comes in.

Pazo is a retail execution platform that helps brands monitor, measure, and improve shelf positioning in real time. It gives complete control over store visibility without relying on slow manual audits or inconsistent field reporting.

Here’s how Pazo strengthens shelf positioning:

Pazo makes it easy for field teams to capture structured shelf data from stores using mobile checklists. Every shelf condition is recorded with timestamps and geo-verification to ensure audit reliability.

With Pazo, shelf images are captured and shared instantly, allowing managers to verify product placement, facings, and brand blocking directly from the dashboard. Photo proof eliminates fake compliance.

Pazo allows teams to compare actual shelf conditions with approved layouts. Any violations or deviations in shelf positioning are flagged for correction immediately.

Brands can measure their visibility by tracking facings, missing SKUs, and visibility score across stores. This helps teams fight shelf share battles with data instead of assumptions.

If a SKU is missing from the eye-level shelf or a competitor has overtaken space, Pazo assigns corrective action tasks instantly to the right store team. Nothing gets missed or delayed.

Pazo also allows retail teams to log competitor positions, promotions, and shelf takeovers. This ensures faster competitive response and smarter shelf negotiations.

With Pazo, brands can implement the same shelf strategy across hundreds or thousands of stores with precise execution. Every store is measured. Every display is verified.

Pazo offers store-level and region-level dashboards to empower sales heads, trade marketing teams, and retail operation leaders with full execution control.

Shelf positioning is not just about getting space—it is about keeping it. Pazo ensures brands never lose visibility due to poor execution, missing facings, or compliance failure at the shelf.

Shelf positioning is more than a merchandising detail—it is a competitive advantage inside the store. The brands that win are not always the ones with the biggest advertising budgets, but the ones that win the battle where it matters most: on the shelf.

Strong shelf positioning increases visibility, drives impulse purchases, improves category dominance, and accelerates sales without increasing marketing spend. But winning the shelf is not a one-time effort. It requires continuous tracking, disciplined execution, and rapid corrective action across every retail outlet.

That is where execution matters more than strategy.

Pazo helps brands take control of shelf execution by giving real-time visibility into store conditions, enabling faster audits, and fixing visibility gaps before they impact sales. With Pazo, retail teams can monitor shelf compliance, recover lost facings, track competitor moves, and protect visibility across every store at scale.

Shelf positioning decides who gets seen. Execution decides who gets sold.

Ready to win visibility at the shelf and increase retail sales performance across every store?

Stay up to date with the latest video business news, strategies, and insights sent straight to your inbox!